DOGE Price Prediction: Technical Setup and ETF Catalysts Point to Potential 45% Rally

#DOGE

- Technical indicators show DOGE is oversold with positive MACD divergence signaling potential reversal

- ETF approval and whale accumulation of 122 million DOGE create strong fundamental catalysts

- Price must break above $0.256 resistance to confirm bullish momentum toward $0.45 target

DOGE Price Prediction

DOGE Technical Analysis: Key Indicators Signal Potential Rebound

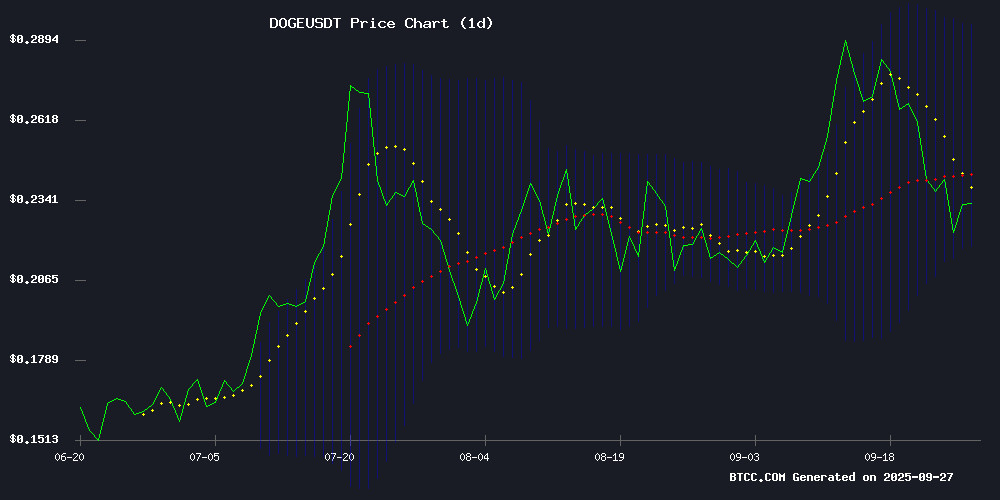

According to BTCC financial analyst Sophia, DOGE currently trades at $0.22995, below its 20-day moving average of $0.256209, indicating short-term bearish pressure. However, the MACD shows a positive divergence with the histogram at 0.017201, suggesting potential momentum shift. The Bollinger Bands reveal DOGE is trading NEAR the lower band at $0.217577, which often acts as support. Sophia notes that a break above the middle band at $0.256209 could signal renewed bullish momentum toward the upper band at $0.294841.

ETF Catalyst and Whale Activity Boost DOGE Sentiment

BTCC financial analyst Sophia comments that the upcoming Dogecoin ETF and significant whale accumulation of 122 million DOGE are creating positive market sentiment. While the technical picture shows short-term consolidation, these fundamental developments could provide the fuel for a move toward the $0.45 target mentioned in recent reports. Sophia cautions that meme coin alternatives like BlockchainFX represent competitive pressures, but the ETF approval remains the primary catalyst for institutional interest.

Factors Influencing DOGE's Price

Dogecoin Price Rally: Can the New ETF Push DOGE to $0.45?

Dogecoin (DOGE) surges back into focus as the first U.S.-listed Dogecoin ETF begins trading on the CBOE exchange. The REX-Osprey Doge ETF recorded $6 million in volume within its first hour—far exceeding Bloomberg analyst Eric Balchunas' $2.5 million daily projection. DOGE's price reacted swiftly, climbing toward $0.30 amid heightened institutional interest.

Further momentum looms as 21Shares' spot-based DOGE ETF advances through DTCC listing, while the SEC reviews applications from Grayscale and Bitwise. Market participants now watch whether ETF adoption can propel the meme coin toward $0.45, a level last seen during the 2021 crypto bull run.

BlockchainFX Emerges as Potential Successor to Dogecoin's Meme-Driven Rally

Dogecoin's improbable rise from internet joke to cryptocurrency heavyweight created instant millionaires, fueled by celebrity endorsements and viral appeal. Now trading at $0.2261 after an 18% weekly decline, traders seek the next high-growth opportunity.

BlockchainFX enters this landscape with $8.2M raised in presale funding, positioning itself as a utility-focused alternative to meme coins. The platform's 'super app' approach combines traditional and crypto markets—a strategic differentiation from exchange giants like Binance and Coinbase.

With live beta testing underway and industry accolades already secured, the project demonstrates uncommon maturity for a presale-stage offering. Its $0.025 token price and impending $8.5M soft cap completion suggest growing institutional interest in multifunctional trading platforms.

Dogecoin Whales Accumulate 122 Million DOGE as ETF Launch Fuels Rally

Dogecoin's market dynamics shifted dramatically this week as institutional products collided with whale accumulation. The meme cryptocurrency gained 22% after two concurrent developments: 122 million DOGE moved to cold storage by large holders, and new ETFs attracted $26 million in institutional inflows.

Exchange order books show concentrated buying at $0.22 support, with whales executing $13 million in spot purchases on Binance. The rising channel pattern now points toward a $0.25-$0.30 target range—a 30% upside from current levels.

This marks Dogecoin's first meaningful institutional adoption since its 2013 launch. The ETF inflows suggest traditional investors are warming to meme assets, while whale accumulation indicates long-term positioning rather than speculative trading.

Is DOGE a good investment?

Based on current technical and fundamental analysis, DOGE presents a mixed but potentially promising investment case. The technical indicators show DOGE is oversold near Bollinger Band support, while fundamental catalysts like the ETF launch and whale accumulation provide bullish momentum.

| Factor | Current Status | Impact |

|---|---|---|

| Price vs 20-day MA | $0.22995 (below MA) | Short-term bearish |

| MACD Signal | Positive divergence (0.017201) | Potential reversal |

| Bollinger Band Position | Near lower band ($0.217577) | Oversold conditions |

| ETF Catalyst | Pending approval | Major bullish driver |

| Whale Activity | 122M DOGE accumulated | Institutional interest |

Sophia suggests that investors should monitor the $0.256 resistance level for confirmation of bullish momentum, with the ETF news serving as the primary catalyst for potential gains toward $0.45.